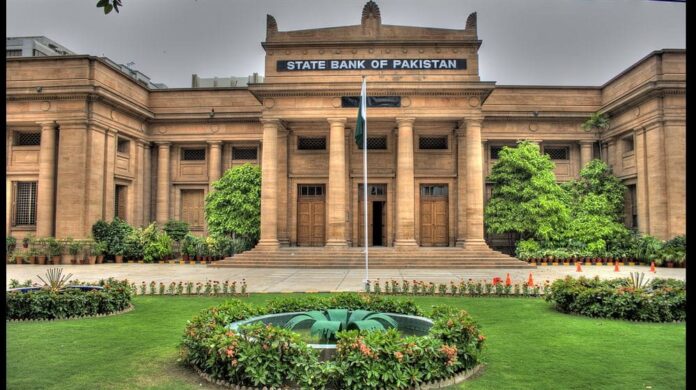

The State Bank of Pakistan (SBP) has now allowed startups to obtain loans as “convertible debt” to help them in securing funding from overseas. “Convertible debt is a type of financing which provides the option to convert the loan into equity shares of the borrowing company, subject to certain terms and conditions,” informed a statement issued by the central bank on Wednesday.

Moreover, in the case of successful startups, they raise an opening round of investment and begin selling their stocks or service to their targeted consumers. However, in the matter of higher growth, they need more capital, for this, the companies need to raise funds from abroad but the State Bank regulations were a hurdle in this way.

Read more: Financial technology startup, Seed Labs raises $6.4 million seed round at $50 million valuation

Prior to the latest instructions, entities were permitted to raise foreign currency investments from abroad within the parameters specified in Chapter 19 of the Foreign Exchange Manual (FEM), however, there was no particular category that presented the possibility of converting the loan into the investment of the borrowing corporation.

Furthermore, the central bank expects that this action will further attract a greater amount of foreign financing as it will provide another option to foreign investors to invest capital into startups running in Pakistan. International investors, which are indecisive to partake in the equity of the startup company at an introductory stage, may grant financing under this category and decide about participation in equity at some later step.

Read more: Katalyst Labs collaborates with HBL for Startup Acceleration and Women Leadership Enablement

Previously, in February this year a working record “Raising of convertible debt from abroad by startup companies” published by the State Bank stated that a new type of investment scheme to satisfy the particular requirements of startup companies is being composed.

Source: Dawn