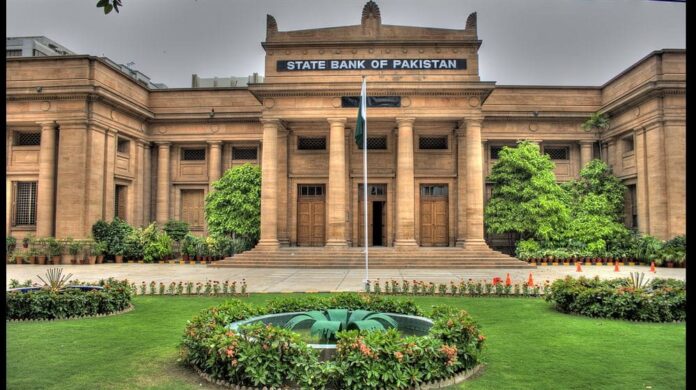

The Government of Pakistan has successfully repaid Rs. 500 billion in debt to the State Bank of Pakistan (SBP), a full four years ahead of its scheduled 2029 maturity.

The repayment, executed by the Debt Management Office (DMO), is being hailed as a watershed moment in Pakistan’s economic governance. Advisor to the Finance Minister, Khurram Schehzad, took to X (formerly Twitter) to announce the achievement, emphasizing its importance in redefining Pakistan’s debt strategy.

It’s a critical realignment swapping out short-term, high-pressure liabilities for longer-tenure debt that stabilizes the country’s repayment schedule. The move drastically reduces concentration risk and offers a cushion against looming financial uncertainty, sending a powerful message to investors and institutions alike: Pakistan is serious about long-term economic health.

This achievement is even more significant because it follows on the heels of another milestone, the government’s Rs. 1 trillion market debt buyback completed by the end of 2024. Together, these two steps amount to the early retirement of a whopping Rs. 1.5 trillion in public debt in FY25.

The results are already showing. Pakistan’s debt-to-GDP ratio has dropped from 75% in FY23 to around 69% in FY25. The average time to maturity (ATM) on public debt has also been extended from 2.7 years to approximately 3.75 years, giving the government more breathing room in its fiscal planning.

The most immediate benefit? A staggering Rs. 830 billion saved in interest payments for FY25—funds that can now be redirected toward pressing development priorities like healthcare, education, and infrastructure.

By capitalising on declining interest rates and embracing a disciplined, forward-looking borrowing strategy, the government is reducing debt burdens and redefining the country’s financial narrative. It signals to the global financial community and domestic stakeholders that Pakistan is taking control of its fiscal future with boldness, clarity, and precision.

The early repayment of the Rs. 500 billion SBP loan might not solve every economic challenge overnight, but it is a firm step in the right direction. And in a region where economic headlines are often marred by crises, this one offers a refreshing dose of financial hope.

Read more: SBP to launch NRLP (National Remittance Loyalty Program) to strengthen the inflow of remittances