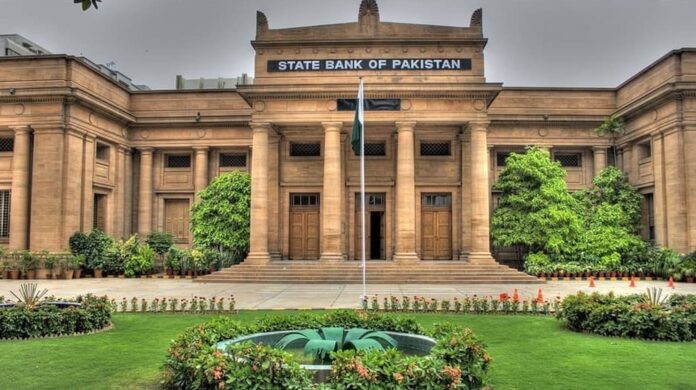

The State Bank of Pakistan (SBP) remains steadfast in its refusal to permit cryptocurrency trade within the country. Despite the increasing global interest in digital assets and ongoing legal battles initiated by investors and traders, the SBP shows no indication of flexibility regarding the trading of cryptocurrencies in Pakistan.

The Firm Prohibition by SBP to Allow Crypto Trading in Pakistan

The SBP, acting as Pakistan’s banking regulator, has explicitly warned all regulated entities against engaging in various activities related to cryptocurrencies. These activities include processing, using, trading, holding, transferring value, promoting, or investing in virtual currencies. In a circular issued in 2018, the SBP emphasized that cryptocurrencies are not recognized as legal tender and that no individual or entity is authorized or licensed to issue, sell, purchase, exchange, or invest in virtual currencies within Pakistan. This clear and definitive stance has set the tone for cryptocurrency regulations in the country.

Despite the ban imposed by the SBP, investors and traders in Pakistan have taken their grievances to the courts, seeking legal clarity on the status of cryptocurrencies. They argue that established cryptocurrency operators should be allowed to conduct their businesses within the country. Nevertheless, the SBP’s unwavering position and lack of flexibility have created significant obstacles for those seeking to participate in cryptocurrency trading activities.

Global Regulatory Landscape

Pakistan is not alone in implementing strict regulations on cryptocurrencies. Countries such as China, Tunisia, Morocco, and Algeria have also imposed bans on virtual currencies. In contrast, other nations such as the United States, India, Germany, France, England, Japan, and the Russian Federation have adopted varying degrees of regulation, allowing cryptocurrency trading to some extent. Notably, El Salvador has gone a step further by recognizing cryptocurrency as a legal tender.

SBP, in the latest Financial Stability Review, explained that the emergence of crypto assets has introduced challenges to the effectiveness of monetary policy, as they operate outside the oversight and control typically associated with traditional elements of the money supply. This lack of regulation can weaken the transmission channels of monetary policy, posing obstacles for central banks in maintaining price stability and effectively regulating the financial system.

Also read: SBP Agrees with FIA’s Investigation Against Illegal Transactions of Cryptocurrencies