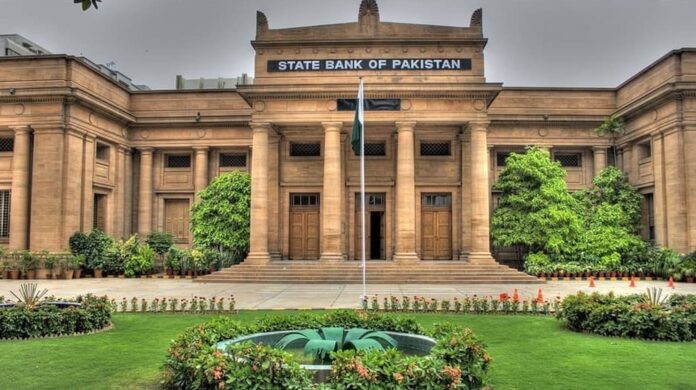

The Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) has announced the hike in the interest rate by 100 basis points (bps) to 21% which is the highest ever in the history of the country. In November 2022, the central bank pushed the rate by 100 basis points to 16%; it has now raised rates by a total of 725 bps since January 2022.

Interest Rate Hike: SBP Governor Blames the Inflation

Governor SBP Jameel Ahmad said that the rationale behind the interest rate hike was that inflationary pressure persists. “Secondly, challenges pertaining to the current account deficit remain as there is a delay over expected inflows. This has added pressure on our foreign exchange reserves,” he further added.

The decision is important to curb inflation, which is critical for achieving the objective of price stability. The central bank said; “Despite a sharp reduction in current account deficit, external account vulnerabilities persist, amidst low FX reserves, ongoing debt repayments and recent tightening in global financial conditions.”

MPC Statement

According to MPC; the recent strains in the global banking system have led to further tightening of global liquidity and financial conditions which have added to the difficulties of emerging market economies like Pakistan to access international capital markets. The committee thinks that the current monetary policy stance is appropriate, and stresses that the decision, along with previous accumulated monetary tightening, will help achieve the medium-term inflation target over the next 8 quarters.

Read more: SBP Jacks Up Interest Rate By 300bps