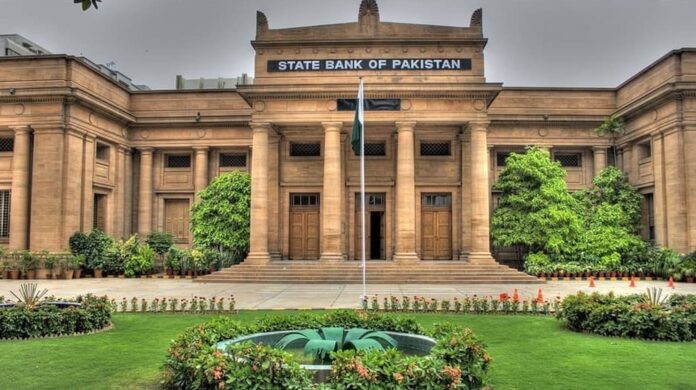

The State Bank of Pakistan (SBP) has maintained the benchmark interest rate at 11%, signaling confidence in the country’s gradual economic recovery and relatively stable inflation environment.

SBP Governor Jameel Ahmed emphasized that inflation currently stands at 7.2%, a manageable figure considering past volatility. Although a slight uptick was observed in May and June, the average inflation for the last fiscal year remained at a modest 4.5%. Encouragingly, food inflation and core inflation both eased over the past year. However, a rebound in core inflation is expected in the coming months, warranting cautious optimism.

Pakistan’s economic indicators show encouraging trends as exports have edged up by 4%, while remittances rose sharply, adding $8 billion to the country’s external account creating the first surplus in 14 years. Imports, too, increased by 11%, driven largely by a 16% surge in non-oil imports, indicating a revival in economic activity

Despite a projected current account deficit of up to 1% of GDP for the current year, remittances are expected to exceed $40 billion, providing critical support to the external balance. GDP growth is forecast between 3.25% and 4.25%, with agriculture, industry, and services sectors all set to contribute positively.

Pakistan faces significant external debt repayments of $25.9 billion this fiscal year, but reduced interest rates and extended loan tenures have improved debt sustainability. Credit rating upgrades from international agencies reflect this improvement.

Foreign exchange reserves have crossed $14 billion, with expectations of hitting $15.5 billion by December and $17.5 billion by June 2026. The issuance of Eurobonds is also on the cards to bolster reserves further.

Meanwhile, SBP remains vigilant in monitoring legal foreign exchange markets and combating illegal currency trading in collaboration with law enforcement agencies. The government also aims to curb gold smuggling and strengthen remittance inflows through targeted policy actions.

The SBP has sent a clear message by holding the policy rate steady: economic stability is returning, but it must be nurtured with vigilance and prudence.

Read more: State Bank of Pakistan Withholds Names of $3 Billion Loan Beneficiaries